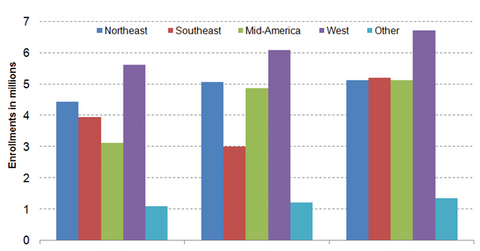

How Is Aetna’s Membership Distributed Across Its Key Markets?

Aetna’s membership is mainly concentrated in the western US, followed by the Southeast, the Northeast, the Mid-US, and finally consolidated international enrollments.

Mar. 17 2015, Updated 5:06 p.m. ET

Key markets

The performance of players in the health insurance industry (XLV) depends largely on the demographic mix, social mix, and regulatory framework in key markets. Accordingly, managed care organizations such as Humana (HUM), Aetna (AET), Anthem, Cigna (CI), and Wellcare Health Plans (WCG) operate in select markets to balance risk and earn sustainable profits.

The above graph shows that Aetna’s membership is mainly concentrated in the western US, followed by the Southeast, the Northeast, the mid-US, and finally consolidated international enrollments in the Middle East, Africa, Asia, and Europe. The sudden increase in Aetna’s enrollments in the Southeastern and the Western markets is mainly attributed to Aetna’s 2012 acquisition of health insurer Coventry Health, with major presence in the Mid-Atlantic, the West, and the South.

Enrollment breakdown

Commercial insurance services, which includes employer-sponsored coverage and individual insurance coverage, accounts for 84.1% of Aetna’s total medical enrollments. The company mainly targets large multi-site national, mid-sized and small employers, as well as individual insureds and expatriates. Around 68.1% of Aetna’s commercial enrollments are self-insured, where the employer assumes the financial risk of probable claim obligations. To know more about self-insured employer-sponsored insurance plans, please refer to Shift to self-insurance plans affects health insurance stocks.

Through the MA (Medicare Advantage) program, the substitute for the original Medicare program delivered by private health insurers, Aetna provides health insurance services to Medicare beneficiaries in certain geographic regions. In 2014, the company offered MA services in 929 counties in 40 states and in Washington DC. Aetna also provides supplemental Medicare services, which provide coverage for out-of-pocket payments of Medicare beneficiaries in the original Medicare program.

In 2014, Aetna entered into contracts with 15 states to provide Medicaid services. The company has also been selected to provide Medicaid services in Louisiana, beginning in February 2015.