What Are Aetna’s Key Business Segments?

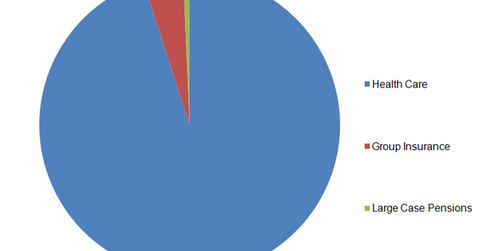

Out of Aetna’s (AET) three business segments, Health Care accounted for 95% of the company’s revenue.

Mar. 16 2015, Published 4:31 p.m. ET

Business segments

Players in the health insurance industry (XLV) rely on an optimal business mix that diversifies business risks while ensuring sustainable profits.

Out of Aetna’s (AET) three business segments, Health Care accounted for 95% of the company’s revenue. The segment was followed by the Group Insurance and the Large Case Pensions segments, which registered 4.3% and 0.7% revenues in 2014, respectively.

Health Care

The Health Care segment provides services such as medical, dental, behavioral health, vision, and pharmacy insurance mainly for employer-sponsored as well as Medicare and Medicaid beneficiaries. The company’s product suite includes offerings such as POS (point of service), PPO (preferred provider organization), and HMO (health maintenance organization) as well as health technology and consumer-centric solutions.

To earn sustainable profits, health insurance companies such as UnitedHealth Group (UNH), Humana (HUM), Cigna (CI), and Aetna (AET) have adopted the strategy of diversification, both across products and markets. Post acquisition of InterGlobal in April 2014, Aetna also offers international private medical insurance for groups and individuals in the Middle East, Asia, Africa and Europe.

Group Insurance

The Group Insurance segment is further differentiated in group life insurance and group disability products. Group life insurance products are mainly offered by employers and provide protection against loss of income in case of the death of the insured employee. Group disability insurance products offer income protection for members in case of a disability, by providing for a part of the lost income for a specified period of time.

Large Case Pensions

This segment provides a variety of investment options for pension plans. An employer sets up a pension plan and makes regular contributions to the plan on behalf of the employee. This money is then invested in various investment products and is available to the employees on retirement.