Why Enterprise Products has growth projects in the Eagle Ford

In 2012, EPD entered into a 50:50 joint venture with Plains All American Pipeline (PAA), to service the Eagle Ford Play.

Jun. 16 2014, Published 5:00 p.m. ET

Enterprise Product Partners

Enterprise Products Partners (EPD) is one of the largest master limited partnerships (or MLPs), providing midstream energy services to producers and consumers of natural gas, natural gas liquids (or NGLs), crude oil, refined products, and petrochemicals. The company operates a vast portfolio of energy infrastructure, storage, and transportation assets, based mostly in the U.S. EPD’s services include NGL pipelines and services, onshore natural gas pipelines and services, onshore crude oil pipelines and services, offshore pipelines and services, and petrochemical and refined products services.

EPD’s midstream asset base covers most major domestic gas producing basins, including the Eagle Ford. One of EPD’s major customers in the Eagle Ford is EOG Resources (EOG), which it has entered into long-term agreements with to provide a comprehensive package of midstream services.

The previous sections talked about how EOG plans to grow its crude oil and associated liquids-rich natural gas production, to meet the requirements of EOG’s growth plans, as well as production growth from other customers. EPD plans to build additional infrastructure.

Eagle Ford joint venture

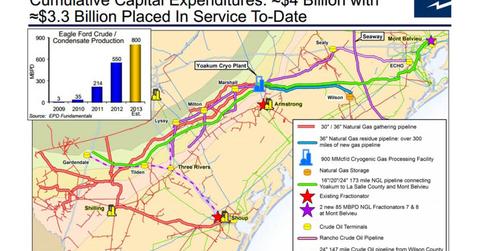

One of its most significant investments into the Eagle Ford include the Eagle Ford joint venture. In 2012, EPD entered into a 50:50 joint venture with Plains All American Pipeline (PAA), to service the Eagle Ford Play. The joint venture includes a 140-mile crude oil and condensate line extending from PAA’s Gardendale facility in LaSalle County to Three Rivers in Live Oak County and continuing on to Corpus Christi, and a new 35-mile pipeline segment from Three Rivers to Enterprise’s Lyssy station in Wilson County. It also includes a marine terminal facility at Corpus Christi and 1.8 million barrels of operational storage capacity across the system.

The system, which came online in September last year, initially had a targeted capacity of 350,000 barrels per day (or bpd), but it was later announced that an 80-mile extension would be added to the total capacity. The extension, also called the Phase-II extension, is being designed with a capacity of 200,000 bpd, mainly to service Chesapeake Energy (CHK) with whom the company has entered into a ten-year agreement. It is important to note that both CHK and EOG are a part of the Energy Select Sector SPDR Fund (XLE).

A company announcement stated that the phase II project, located in the southwestern crude oil producing region of the Eagle Ford, would address the lack of pipeline infrastructure in this region. The joint venture also plans on building an additional 2.3 million barrels of storage capacity to service the expansion. This project is expected to be completed and in service by 2Q15.

Additionally, to accommodate the increased volumes from the Eagle Ford Shale and other producing regions, Enterprise is moving forward with plans to construct an eighth fractionator. EPD began operations at its seventh NGL fractionator at Mont Belvieu in September, 2013. The facility fractionates up to 85 MMbpd (million barrels per day) of NGL, increasing Enterprise’s total fractionation capacity at Mont Belvieu to 570 MMbpd. The new fractionating unit is expected to raise total capacity at the Mont Belvieu complex to 655 MMbpd and increase Enterprise’s total fractionation capacity to more than 1 MMbpd. Readers should note that Fractionators seven and eight are being developed as part of a joint venture with Western Gas Partners L.P. (WES).

WES, PAA, and EPD are all a part of the Alerian MLP ETF. EPD is a significant component of AMLP. To read about other major components of the AMLP, read our Market Realist series Must-know: An investor’s guide to the Alerian MLP ETF (AMLP).

Continue reading the next section of this series to learn about one more midstream that is counting on the Eagle Ford Shale.