Recommendation: Should investors bet on an oil price drop?

Shorting crude oil ETFs or purchasing some inverse ETFs can provide exposure to downside movements in crude oil prices.

Nov. 22 2019, Updated 5:40 a.m. ET

Playing crude oil prices

As we discussed earlier in this series, futures are one way to play crude oil prices, and an investor could sell crude futures contracts if taking a bearish stance. However, entering into this kind of trade could be too risky for individual investors due to high leverage and the required size of a minimum position. See the previous part of this series for more background.

Crude oil ETFs are a straightforward way to play oil prices

Like natural gas, there are ETFs that specifically target crude oil price fluctuations, which are a very straightforward way to play oil. For example, the United States Oil Fund’s (the USO’s) stated objective is to have its net asset value reflect changes of the price of WTI crude oil delivered to Cushing, Oklahoma, as measured by changes in the corresponding WTI crude oil futures contract on the NYMEX. If you believe that crude oil prices will fall, it’s possible to short ETFs that track crude prices such as the USO.

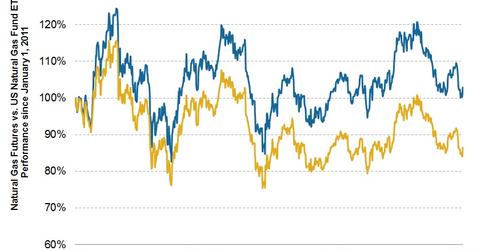

However, note again that there’s some tracking error between the ETF and actual price changes in crude oil. The graph above shows crude oil returns from the beginning of 2011 compared to returns on the U.S. Oil Fund ETF over the same period.

If betting on a decrease in crude oil prices, it’s also possible to purchase shares of ETFs whose objective is to track the inverse of crude price movements, so the value of the ETF increases when crude prices decrease. These ETFs include the ProShares UltraShort DJ-UBS Crude Oil ETF (SCO) and the United States Short Oil Fund (DNO). Note, though, that these ETFs also have significant tracking error and can be extremely risky, as crude prices are very volatile and can spike rapidly.